CARPE DIEM

Sunday, September 27, 2009

Florida Real Estate Market Recovery: 12th Consecutive Monthly Increase in Home Sales

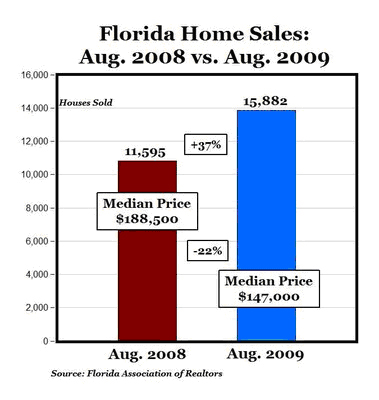

Florida’s existing home sales rose in August – marking a full calendar year (12 months) that sales activity increased in the year-to-year comparison, according to the latest housing data released by Florida Realtors®.

Existing home sales rose 28 percent last month with a total of 13,850 homes sold statewide compared to 10,813 homes sold in August 2008, according to Florida Realtors. The state association also reported a 45 percent increase in last month’s statewide sales of existing condos compared to the previous year’s sales figure.

Sixteen of Florida’s metropolitan statistical areas (MSAs) reported increased existing home sales in August; 18 MSAs also showed gains in condo sales. A majority of the state’s MSAs have reported increased sales for 14 consecutive months.

“For a year now, statewide sales of existing single-family homes in Florida have increased each month compared to the year-ago figures,” says 2009 Florida Realtors® President Cynthia Shelton, CCIM, CRE, a broker and director of investment sales with Colliers Arnold in Orlando. (CCIM stands for Certified Commercial Investment Member and CRE is the Counselor of Real Estate designation). “This is encouraging news, and while it shows the beginnings of recovery, the housing market still needs time to continue its gradual absorption of housing inventory that will help stabilize home prices. That is why it is critical for Congress to extend the first-time homebuyer tax credit into 2010. And, because it’s now taking longer to finalize a home sale, first-time buyers who want to take advantage of the $8,000 federal tax credit need to act quickly, or they may miss the closing deadline of Nov. 30, 2009.”

Florida’s median sales price for existing homes last month was $147,400; a year ago, it was $188,500 for a 22 percent decrease. Housing industry analysts with the National Association of Realtors® (NAR) note that sales of foreclosures and other distressed properties continue to downwardly distort the median price because they generally sell at a discount relative to traditional homes. The median is the midpoint; half the homes sold for more, half for less.

The national median sales price for existing single-family homes in July 2009 was $178,300, down 14.6 percent from a year earlier, according to NAR. In Massachusetts, the statewide median resales price was $310,000 in July; in California, it was $285,480; in Maryland, it was $273,769; and in New York, it was $205,000.

Signs point toward continued positive momentum in the housing sector, according to NAR’s latest industry outlook. NAR Chief Economist Lawrence Yun predicts existing home sales will rise through the fourth quarter. “Unless the tax credit is extended, no one should be surprised to see home sales drop in the first quarter of next year,” he said. “However, the fundamentals of the housing market and the economy are trending up, and we expect home sales to generally pick up in the second quarter of 2010. The buyer psychology may be shifting from, ‘Why buy now when I can purchase later,’ to ‘I don’t want to miss out on a recovery.’”

In Florida’s year-to-year comparison for condos, 4,674 units sold statewide compared to 3,222 units in August 2008 for a 45 percent increase. The statewide existing condo median sales price last month was $107,500; in August 2008 it was $158,100 for a 32 percent decrease. The national median existing condo price was $178,800 in July 2009, according to NAR.

Interest rates for a 30-year fixed-rate mortgage averaged 5.19 percent last month, down significantly from the average rate of 6.48 percent in August 2008, according to Freddie Mac. FAR’s sales figures reflect closings, which typically occur 30 to 90 days after sales contracts are written.

Among the state’s larger markets, the Daytona Beach MSA reported a total of 686 homes sold in August compared to 573 homes a year earlier for a 20 percent increase. The market’s existing home median sales price last month was $132,700; a year ago it was $164,200 for a 19 percent decrease. A total of 135 condos sold in the MSA in August, up 27 percent over the 106 units sold in August 2008. The existing condo median price last month remained level compared to a year ago at $184,300.

Source: © 2009 Florida Realtors®

Also published by : Professor Mark J. Perry's Blog for Economics and Finance

About Professor Mark J. Perry:

Name: Mark J. Perry

Location: Flint, Michigan, United States

Dr. Mark J. Perry is a professor of economics and finance in

the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. Since 1997, Professor Perry has been a member of the Board of Scholars for the Mackinac Center for Public Policy, a nonpartisan research and public policy institute in Michigan.